Google wants to help you find a job with its new service

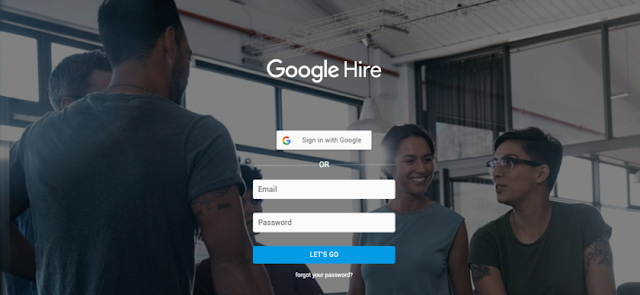

It looks like Google is preparing to go head to head with services like Greenhouse, Jobvite, and others. The online search giant will launch Google Hire, a service that allows companies to post job listings as well as accept and manage applications. Google Hire hasn’t been officially announced yet, but the website is already live. The sign in page is visible to everyone, while everything else is hidden at the moment. As of now, there’s no word on exactly when the service will be launched. However, based on the fact that the website is already up, we probably won’t have to wait for much longer. According to Axios, quite a few technology companies are already working with Google and testing out the new platform. These include Medisas, Poynt, DramaFever, SingleHop, and CoreOS. The company will try to expand its enterprise business with the help of Google Hire. The project is part of Google’s enterprise and cloud division led by Diane Green, who is the founder Bepop, a company a